BUSINESS OVERVIEW

The We Do It Right principle continued to be a guiding force for Hang Lung Properties during the year. Despite challenges in the property market, we remained committed to building quality properties in the right locations and creating world-class mixed development projects.

In 2013, steady rental turnover from both our existing well-managed portfolio and new developments contributed to the impressive results we achieved. This enabled us to deliver yet another year of stable growth for our shareholders.

Total turnover was HK$9,138 million, up 24% from the previous financial year. As there was insignificant gain on disposal of investment properties compared to 2012, underlying net profit attributable to shareholders was down by 18% to HK$5,050 million, while earnings per share fell 18% to HK$1.13 as a result.

24%

|

12%

|

|

|||||||||||||||||

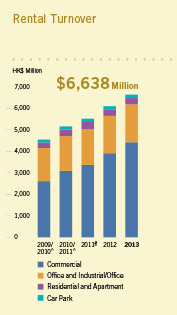

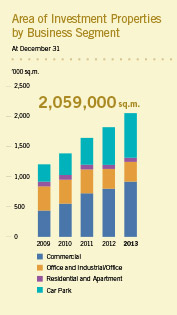

PROPERTY LEASING

We continued to enjoy solid rental turnover and operating profit growth in our core business of property leasing for the 12-month period ended December 31, 2013. Rental turnover and operating profit both rose 12% to HK$6,638 million and HK$5,326 million, respectively, when excluding the impact of the discontinued operations. Overall, both increased by 9% year-on-year. Overall rental margin was 80%.

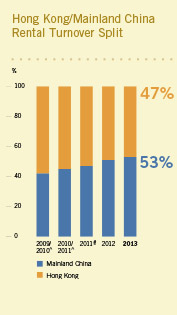

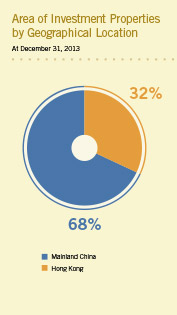

Hong Kong

Rental turnover and operating profit generated from our Hong Kong investment properties were up 10% and 11% to HK$3,112 million and HK$2,643 million, respectively, on a comparable basis. Overall, rental turnover and operating profit rose 3% and 5%, respectively, compared to a year ago.

In 2013, the property leasing business in Hong Kong contributed 47% to the Group’s total rental turnover.

Mainland China

Although economic growth on the Mainland was relatively moderate in recent years, Hang Lung continued to achieve stable growth in this market, with total rental turnover rising to HK$3,526 million, up 14% from the previous year, and operating profit increased by 13% to HK$2,683 million.

One of the Group’s new developments, Center 66 in Wuxi, opened in September 2013 with 95% occupancy rate, which accounted for a rental turnover of HK$77 million in the first three months of operation.

Plaza 66 and Grand Gateway 66, which have been part of the Group’s strong foothold in Shanghai since the early 2000s, recorded stable occupancy rates at 96%. Rental turnover from these properties amounted to HK$2,640 million, up 6%.

In Shenyang, Forum 66 was almost fully let, with occupancy rate recorded at 99%. Palace 66 is now reshuffling the tenant mix after the completion of the first lease term, with occupancy rate recorded at 88%.

In Jinan, the capital city of Shandong Province, Parc 66, in the course of tenant reshuffle, recorded a slight increase of 1% in rental turnover to HK$367 million.

Following the expansion of our mainland China operations, this side of the business now accounts for 53% of the Group’s total rental turnover.

PROPERTY DEVELOPMENT

In September 2013, the Group reached a milestone in its development with the grand opening of a new landmark shopping mall – Center 66 in Wuxi, Jiangsu Province. It is now home to more than 250 world-class tenants bringing an all-new shopping and leisure experience to the public in Wuxi.

Center 66 is strategically located in the Yangtze River Delta for tapping into the enormous potential of mainland China’s most dynamic economic region. Situated in the heart of the city’s central business district, Renmin Zhong Lu in Chong’an District, the mall of Phase 1 has a gross floor area of 118,135 square meters, excluding the car park areas. In addition to the shopping mall, the first phase of this development will ultimately comprise two Grade A office towers that are due to be completed in stages from 2014.

On November 19, 2013, the Group held a groundbreaking ceremony in Wuhan for Heartland 66, a new commercial complex that marks the Group’s first entry into central China. Located in the commercial and business heart of Wuhan, Heartland 66 is a showcase of modern architecture blending the best design elements of East and West. The project is the Group’s 10th development on the Mainland and will be its flagship property in this part of the country when completed in phases from 2019.

Another upcoming shopping mall development, Riverside 66 in Tianjin, will have its grand opening in the third quarter of 2014. Pre-leasing of the mall’s world-class retail facilities has already begun.

A topping-out ceremony of its major structure was held for another of the Group’s major landmark projects, Olympia 66 in Dalian, Liaoning Province, on November 26, 2013. When it opens in 2015, Olympia 66 will become the largest commercial landmark in Dalian, occupying a total gross floor area of around 221,900 square meters (excluding the car park areas). It will feature a series of interconnected atrium spaces, with more than 400 shops, a cinema and skating rink.

All other projects under development on the Mainland were progressing well during the year.

FINANCIAL POSITION

We continued to enjoy a healthy balance sheet during the year. Cash and bank balance amounted to HK$34,321 million. After deducting total borrowings of HK$34,979 million, the Group had a net debt to equity ratio of 0.5%.

With our strong financial position, we have ample capacity not only to fund our current development projects, but also to capture any future expansion opportunities that may arise.

OUTLOOK

Over the years, Hang Lung has evolved into a leading national commercial property developer with operations across many cities – a transformation made possible by our deep knowledge of the Mainland property market and our focus on quality designs. This, along with our financial strength, has enabled us to overcome the impact of the recent market slowdown and to capitalize on opportunities for acquiring land.

In Hong Kong, we have an outstanding portfolio of properties in excellent locations that allows us to attract and retain high quality tenants. We also periodically refine our tenant mix, upgrade our properties and run regular promotional campaigns in order to maintain the attractiveness and profitability of our properties. In addition, we closely monitor the residential market and release residential units for sale at the most opportune time.

In Tianjin, Riverside 66 will open in 2014. Other projects in mainland China, all of which carry our renowned “66” brand name, are progressing well as planned and will come on stream over the next few years.

As a result of the continuing progress we have made in the past year, we are confident about our long-term development prospects both in Hong Kong and on the Mainland, despite the economy is full of challenge for the year ahead.

| Copyright © 2014 Hang Lung Properties Limited. All Rights Reserved. | Disclaimer | Privacy Statement |