CHAIRMAN'S LETTER TO SHAREHOLDERS

Ronnie C. Chan

ChairmanRESULTS AND DIVIDEND

Compared to the previous year, turnover rose 24% to HK$9,138 million. Net profit attributable to shareholders decreased by 14% to HK$7,212 million due solely to much fewer disposals of Hong Kong non-core investment properties and thus a relatively insignificant gain therefrom. Correspondingly, earnings per share retreated 14% to HK$1.61.

When excluding all effects of revaluation gain, the underlying net profit attributable to shareholders fell 18% to HK$5,050 million. Underlying earnings per share came down similarly to HK$1.13.

The Board recommends a final dividend of HK$0.58 per share. If approved by shareholders, total dividends per share for the year ended December 31, 2013 will be HK$0.75, an increase of 1.4% over the previous year.

BUSINESS REVIEW

Excluding the effect of alienated Hong Kong investment assets, overall rental turnover and operating profit both rose by 12%. Even with a smaller Hong Kong portfolio, the two numbers still grew by 9% each. Looking at our home market alone, turnover and operating profit respectively advanced by 10% and 11% on a like-for-like basis and by 3% and 5% otherwise.

On the Mainland, rental turnover rose 14% and operating profit 13%. On retail space alone, turnover grew 17%. If we exclude Shenyang Forum 66 and Wuxi Center 66, rent advanced by 5%. The equivalent number for offices was 7%. Comparing these figures to those of twelve and six months earlier reveals a deceleration from a year ago and a pick-up in the immediate past six months.

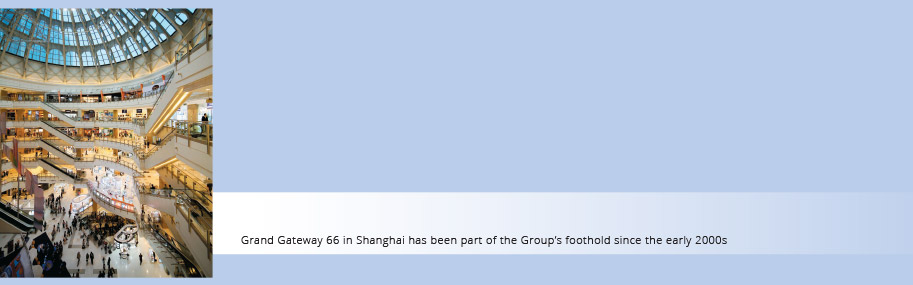

Focusing on the mature market of Shanghai, both shopping centers – Plaza 66 and Grand Gateway 66 – recorded a 6% increase in rent. Offices at Plaza 66 collected 7% more rent. Gross yield on unleveraged investment cost was about 42%. Mall occupancy was 99% and for offices, 95%.

In our newer cities – Shenyang and Jinan (not counting Wuxi which is only three to four months old) – we have observed an interesting phenomenon: namely, as occupancy fell somewhat due to first-time lease renewal and hence tenant remixing, retail sales actually rose nicely from a year ago. The increase from the first half of the year to the second half was also evident. This should be the result of management efforts rather than market improvement. The fact was: the market went nowhere as the year progressed.

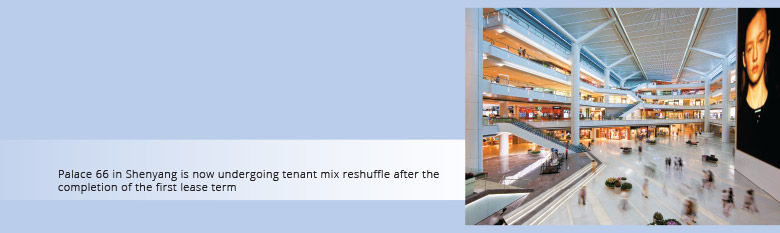

Most of our retail leases are for two or three years. By 2013, Shenyang Palace 66 has been open for three years and Jinan Parc 66 two. Some tenant changes were inevitable resulting in higher vacancy levels. This is the nature of the business which is necessary for the long-term health of the malls. Consequently occupancy remained at 88% for both properties. Rent collected was about the same as that received a year ago, but retail sales of our tenants have risen – year-on-year Palace 66 moved up 9% and Parc 66, 8%. Comparing the second half of the year versus the first half, the rate of increase was respectively 20% and 7% for the two malls.

Common sense tells us that retail sales figures are as significant as the rents we received, for growth of the former is a prerequisite and will inevitably lead to that of the latter. Recent numbers indicated that our tenant remixing was bearing fruit. Weaker shops were moved out and stronger ones capable of generating more sales were being introduced. I am also gratified to observe that the new management teams that we have put in place are performing. Although the improvement in occupancy at Palace 66 has not been as fast as we had hoped, much of the vacant space has been leased, so occupancy will rise in the coming months.

The newer Shenyang Forum 66 is for now performing well. Because it only has slightly more than one year of history, a meaningful way to measure progress is by using per diem numbers. For example, average daily rental turnover was 4% higher in 2013 over 2012. Retail sales generated per day were 15% better in the same period. However, as the facility enters its first lease renewal period in the coming year or two, what happened at Palace 66 and Parc 66 will doubtless repeat itself – occupancy will temporarily fall. Hopefully tenant sales will continue to rise and so will our rental turnover.

All “vital signs” for Wuxi Center 66 which was three and a half months old at year end were positive. It is 95% full and the number is rising.

In terms of rental margin, Palace 66 remained at 22-23%; Parc 66 was still at around 54% which was the same number for Forum 66. Center 66 stood at 16%.

The initial unleveraged gross rental return on investment cost is a meaningful measure. It is intriguing to learn from several institutional investors that certain market players promised around 9% but actually delivered only 1-2% on a rather non-transparent definition of cost. Whereas we always tell shareholders that we aim for 4-5%, all but one newly opened malls of the past four years have significantly outperformed the threshold. Parc 66 yielded 7.9% in its first year, Forum 66 had about 10% and Center 66 at today’s run rate should approximate that of Parc 66. In other words, we doubled what we told investors. Due to very weak market conditions, these properties have yet to see brisk improvements in this regard but they surely will. In fact the greatest progress in the coming year or two may well come from the laggard Palace 66, whose number still stands at about 5%.

Now let me turn to a more general review of the market condition for our Mainland rental business. Eighteen months ago, I wrote that although the 2008/2009 financial crisis was much more severe, recovery of the present downturn in Chinese luxury goods sales may in fact take longer. I have unfortunately been proven correct. One reason is that besides normal economic cyclicalities, the market lull today is partly government induced. Anti-corruption and anti-opulence measures instituted by the new government and targeting officials are biting hard.

While these policies have negatively affected our business in the short term, we fully support them. Any sector such as ours should not rely on irregular practices. If it does, the resulting degradation of social moral values will undoubtedly haunt the economy. We are a long-term player and want to see a healthy and clean economy. Moreover, given our extraordinarily strong financial position, the market slowdown probably hurts our competitors more. History also shows that we can better take advantage of bear markets.

As our shareholders know, whenever the economy is down, our project development team tasked with land acquisition will be particularly busy. City governments may not be able to sell land and so their coffers are strained. Here comes Hang Lung! We know that opportunities are beckoning as municipal leaders from many corners of the country begin to stalk us. Counting the number of city leaders represented at our public events such as a project groundbreaking or a mall opening is one way to gauge how slow the market is.

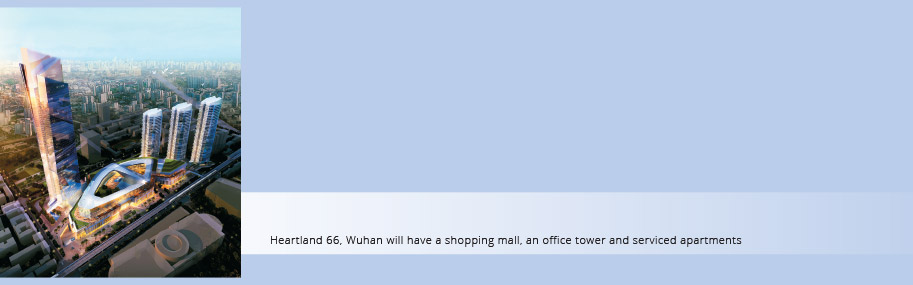

With this background in view, last February we bought an excellent plot of land in the biggest city in central China, Wuhan. It is located in the busiest shopping district and is sizable, measuring 8.26 hectares. This is so far the second largest piece of land that we have purchased on the Mainland after the 9.2-hectare Shenyang Forum 66. We shall first construct a mall followed by an office tower and blocks of serviced apartments that can be sold by individual units. Buildable space is 4.9 million square feet; including car parks, it will be 7 million square feet.

Consider our timing. 2012 was a slow time for home builders so they did not have money to buy land. Consequently, many municipal governments were in financial difficulties. That was when we struck the Wuhan deal. As 2013 arrived, the market turned. Developers sold their residential units and so needed to replenish their land bank. The finances of cities improved and so they were less eager to part with land. Prices rose and previous highest records were repeatedly broken. Under these circumstances, seven months after we bought ours, a piece of similar size, close by but much inferior in location, shape and permitted usage, was sold for twice our unit price. This demonstrates again that our timing, like that for our other acquisitions, was excellent.

Some investors have recently asked about our share price. Perhaps they are used to our outperforming our peers. It is true that for much of the 2000s and until early 2011, our stocks have had a powerful run-up. Our total return, mainly buoyed by the share price rise, surpassed most if not all real estate counters. Why then has our price retreated of late?

There are several reasons. First, China has fallen out of favor for many institutional investors. In particular, retail sales, especially luxury products like those in our malls, were even harder hit. The market behavior is understandable, for after all, there was previously a certain amount of irrational exuberance. The latest round of the anti-corruption and anti-opulence drive had added frost.

There is no denying that for the first time in a long while, the sales of luxury goods lag behind general consumption. Although many of our malls such as Shanghai Grand Gateway 66, Shenyang Palace 66, and parts of Jinan Parc 66 and Wuxi Center 66, are not tailored to high fashion brand seekers, our reputation for being developers of worldclass luxury malls has been so ingrained that investors might have forgotten our other businesses.

Then there is a market perception that of all the Hong Kong real estate counters, Hang Lung is the purest Mainland play. There is a certain truth to that, although some 47% of all rents received and so far 100% of property sales proceeds are still derived from our home market. But that does not matter – when China fell out of favor, our share price suffered.

The perception existed probably because of three factors. First, we were perhaps the first among top-tier Hong Kong developers to publicly state that our future is on the Mainland. Secondly, we were among the earliest to have made sizable amounts of profits from the Mainland market. Thirdly, we have hardly bought any land in Hong Kong since 2001 while we have acquired several rather large pieces in several cities on the Mainland.

A common misconception here is that Hang Lung was the first to enter the Mainland market and so bought land cheap, thus the good profit. The fact was that many Hong Kong companies invested north of the border well before we did – as early as 1979 or 1980 – while we only started to research the market in 1991 and made our first land acquisition in December 1992. Because we were a novice in those days, the two Shanghai plots were in fact bought at the peak of the cycle. It took some ten years for prices to return to our purchase level. We have succeeded in spite of a high land price!

Besides external market factors, there are also issues relating to our operations. First and foremost were the difficulties encountered at Shenyang Palace 66. Challenges abounded during construction and there were more to come after the opening in late 2010. I have written extensively about them and so will not repeat them here. Suffice to say that with that facility being the first outside of Shanghai on the Mainland, shareholders rightfully question if our huge success in Shanghai can be duplicated elsewhere. The sustained market slowdown presently experienced also cast a negative light on our business.

From the perspective of management, we are not that worried about our share price. We are here to manage the Company and not the price of its scripts. We know that our business model is excellent and we have taken many correct decisions (such as land acquisitions and building designs) which will sooner or later bear fruit. Operational challenges which take time to improve are not perennial. They are nothing more than teething problems.

That said, we are well aware of the frustration that some shareholders, especially those with a short-term horizon, may feel. Perhaps that was why from time to time shareholders would ask if we plan to buy back our own shares. My standard answer is: the day you see Hang Lung Properties buy back its own shares is the day when you should sell. We are facing one of mankind’s biggest and best economic opportunities of the 21st century – the rise of China with seemingly unending urbanization and consumption growth. In such a favorable environment, we have found a niche (i.e. developing, owning and managing world-class commercial complexes) which is not fiercely competitive due to the lack of expertise on the part of market practitioners. With 85 cities having a population of five million or more and another 91 with three to five million, the market seems unlimited.

At the same time, Hang Lung has through hard work over long years built a top-notch reputation backed by successful developments and a solid management team. Together with our uncannily strong financial position, it seems that few people are as well positioned as we are to take advantage of these humongous opportunities.

When unsatisfied market demand far exceeds our financial capabilities, we should expand our balance sheet, for size matters. Given that, why should we buy back our own shares which has the effect of shrinking the balance sheet!? That would be a clear signal to the investment community that we do not know how to beneficially deploy our cash.

Nevertheless, in our opinion it is altogether reasonable, indeed prudent, for our parent company Hang Lung Group to buy Hang Lung Properties’ scripts. Public information indicates that such has been ongoing.

Indeed it is not a difficult case to make that the shares of Hang Lung Properties are today inexpensive. One only needs to take a cursory look at the main asset classes in our balance sheet – properties for sale and for lease in Hong Kong and on the Mainland.

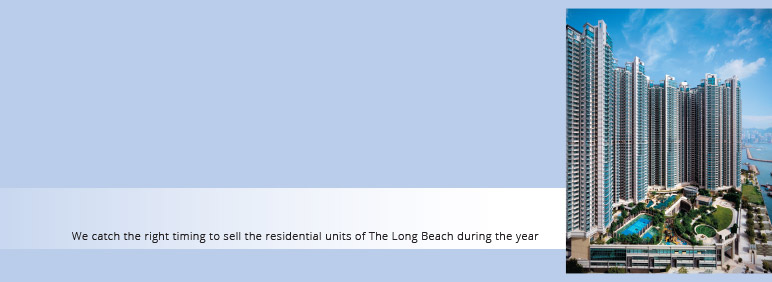

First, our completed Hong Kong apartments for sale are recorded at cost according to accounting rules. On the books the value is around HK$5.7 billion. At today’s somewhat weak market sentiment, they should still be worth perhaps HK$20 billion.

Secondly, when we sold approximately HK$5.3 billion of Hong Kong non-core investment properties in 2012, prices fetched were on average 74% higher than book. And since we revaluate those properties every six months, the value indicated on the account cannot be significantly more than half a year old. This indicates that there is much hidden value.

Then consider our investment properties on the Mainland. For the two mature developments in Shanghai, the cap rate chosen by a third party expert valuer is between 7.5% and 8.2%. About two years ago, another mall developer/owner with much less profitable projects (according to public records) went public with a cap rate of around 4.5%. We believe that their growth prospects are inferior to ours.

As illustrated earlier, all the land that we have bought outside of Shanghai has appreciated substantially. It is common knowledge in the industry that our sites, while being best located, cost the least among our peers. Our timing is consistently among the best. As a percentage of total project cost, the land element for us is below 20% while the norm for the industry is likely 40-50%. As such, it seems obvious that our assets are worth much more than what is on the book.

Finally, we have as much as eight million square feet of luxury residential condominiums that can be sold unit by unit. They are located in Shenyang, Wuxi, Kunming and Wuhan. Once built and sold, it is conceivable that the net after-tax profit therefrom can easily exceed HK$10 billion. What are they valued on our books today? Only at land cost. These are all public information, yet hardly any analyst has pointed them out.

While the stock market in the long term is rather efficient, it can misprice in the short term. We know best the underlying value of the Company as well as its potential. Since our time horizon is very long, we will always outperform almost all short-term stock traders. If our parent Company Hang Lung Group continues to buy our scripts, I can hardly think of a scenario which is not advantageous to both their shareholders and ours.

STRATEGIC INITIATIVES

For several years now management has been following developments in e-commerce. We have invited Chinese experts to address our Board, (including Non-Executive Directors) and to educate our executives. Our tentative conclusion is as follows:

There is no question that retail e-commerce – B2C+C2C – will take an increasingly larger share of the private consumption pie. Between 2009 and 2012, it grew at approximately 70% annually and is projected to rise by 32% per year up to 2015. Between 2008 and 2012, China’s non-online retail expanded 1.8 times in volume while retail online leapt 19 times, albeit from a very low base. By 2015, online retail volume is expected to account for over 10% of all consumer retail sales. Transactions at physical shops will inevitably be affected.

E-commerce is fast becoming a way of life, not unlike telephones a century ago and smartphones almost a decade ago. Just as these earlier transformative inventions did not replace automobiles or airplanes because people still have the need to physically interact, neither will online shopping displace malls. After all, humans are social beings who have the need not only to see and hear but also to feel, touch, smell and otherwise physically meet with their fellowmen. As far as I am concerned, anyone who thinks otherwise is from another planet!

Certain types of goods are more vulnerable to online shopping than others. Standardized and commodity-like products will be the first to be affected. Electronic appliances and lower price-point clothes and shoes are prime examples. On the other hand, fast consumables like fresh fruits, customized long tail or high-touch products like high fashion, and experience-based shops like restaurants are less affected or are not affected at all. In this regard, our long-standing focus on high-end malls has made us less exposed.

One phenomenon of Chinese e-commerce supports this assertion: namely, the less developed a city is, the more it is affected by it. So first tier Chinese cities are less dependent on it than second tier cities, and so on. The reason is simple. In less developed places with poor distribution channels such as the lack of department stores and shopping centers, citizens have little choice but to resort to the Internet for shopping. In metropolises like Beijing and Shanghai where physical stores abound, there is less need for it, even though their citizens are on average better educated and so in general more active online. This explains why e-shopping is less prevalent in places like Hong Kong even though it has a citizenry of high Internet dependence.

The same phenomenon seems to indicate that there is an upper limit to retail e-commerce although that point is still quite far away. Every community will sooner or later find its steady-state level for a particular category of products in terms of the percentage of total sales that will take place through the Internet.

A corollary to increased online shopping is that some brands will no longer need to open as many stores as they otherwise would. For example, they may only have 30 strategically chosen locations around China rather than say 100 or more. To be sure, physical stores are almost always required. In answer to the question on CNN: “What should be the first step for a Western brand desiring to enter the Chinese online retail space?” a Shanghai-based e-commerce expert advised the brand to look for the best located bricks and mortar!

So far we only have 10 malls – six operating and four being built – in eight Chinese cities not counting Hong Kong. Since they invariably have occupied the best locations in top commercial cities, our ability to attract the reduced number of tenants is perhaps unmatched. Consequently, retail e-commerce should not negatively impact us that much. On the contrary, as I have previously explained, the reduction of the number of stores for a particular brand in any city will only lead to city-wide sales being concentrated in fewer shops. Our being one of them will actually be a benefit.

Some have expressed concern that e-commerce will reduce the remaining shops to nothing more than an advertisement space where few sales actually take place. A curious case in this regard is the Apple stores. The technology company does not expect their chic-looking shops teeming with young staff to generate much sales. They are there for customer experience and product familiarization, besides advertising value. Much of the resulting sales may well take place through the Internet. The reason is that Apple basically sells standardized products. As mentioned earlier, long tail or high-touch goods are much less affected.

In this regard, it is fortuitous that Hang Lung has from the beginning insisted on charging all tenants a healthy base rent. This is quite unlike many of our competitors. The ability to negotiate a solid guaranteed rent depends of course on the bargaining power of the landlord relative to that of the tenant. It has always been our practice to put ourselves in a position where the desirable tenants need us as much as we need them. We accomplish this by insisting on the four competitive advantages mentioned in my previous reports for all of our malls, namely top location, adequate size, superior design and quality construction.

This leads me to comment briefly on the occupancy cost for tenants. In the extreme case of the Apple stores mentioned above, it can be extraordinarily high. Given the purpose of their stores, the model is more than sustainable.

Some analysts are dogmatic about this, saying that if the cost is too high, the landlord’s ability to raise rent is limited. Generally speaking this is correct. However, it is hard to determine what the optimal level is. Notice that the general level in one city can differ substantially from that of another. For example, occupancy cost in Hong Kong for the same brand is in general considerably higher than that on the Mainland. Even in the same city, multiple stores of the same brand will inevitably have different acceptable levels. This is because many factors are at play – the prestige of the mall, current and prospective sales volume, advertising value of the shop, relationship between the lessor and the lessee, etc. As such, one should be careful not to generalize too much. Conceptually speaking, occupancy cost should be higher in better malls like ours.

There is no denying that the Internet has revolutionized our lives. For the shopping center business, its significance is much more than just taking some business away through online shopping. It can also help us generate sales. It is an enabler whose effects are indeed profound. By influencing how a person – any customer of ours – relates to another person and to the world around him or her, it can have the effect of warping time and space. It has revolutionized much of our lives and will yet revolutionize our shopping experience.

This is why we recently instituted an in-house program that we call EST. It stands for Experience, Service and Technology. From management’s perspective, the order is the reverse. We begin with technology, especially Internet technology, which enables us to provide services heretofore not possible. As a result, shopping at our facilities becomes a pleasant experience. All these are the software of our business.

In our business, no software, irrespective of how good it is, will be effective unless the hardware is adequate. After all, the former can always be installed, changed or improved. The latter however, once built, can never be altered. This is why I coin the term “real estate genetics.” Let us not go so far – and be so foolish – as to think that hardware is less important. To the contrary!

We are of the opinion, and many people will agree with us, that Hang Lung has some of the best hardware in the industry. I have now challenged my team to also be among the top in software. If not, the market leadership that we have built will not be secure. Conversely, by introducing superior services enabled by technology which bring about desirable customer experiences, our position in the industry will be unshakable. Your management has been working on many programs in this regard and will gradually introduce them to our shopping centers. Some will be quite subtle while others may be more easily felt. All of Mthem should have the effect of improving customer experience and, eventually, our bottom line.

PROSPECTS

With the latest land acquisition in Wuhan, we will have a total of almost 42 million square feet of world-class commercial space on the Mainland not counting the two Shanghai complexes. Of that, a little over 10 million square feet have been completed and the rest are under construction at varying stages. The eight developments are in seven cities with two in Shenyang. The total cost including reasonable finance expenses is about HK$92 billion, almost half of which has been expensed. The unpaid portion comprises mainly construction.

In the past four years, we have completed the equivalent of one New York Empire State Building annually. At this speed, it will take 12-13 years to build out the 32 million square feet still under construction. This will be a very aggressive program.

Once we are all done and not counting any new projects yet to be undertaken, we will own close to 47 million square feet of China’s best commercial real estate. Add to that the seven million square feet of Hong Kong investment properties (provided that we do not take up more or sell off any), we will have a portfolio of about 54 million square feet. 87% of it will be on the Mainland as compared to 68% now. Hong Kong’s share will be reduced from today’s 32% to 13%.

In the third quarter of this year we will open Tianjin Riverside 66, a large freestanding mall of 1.6 million square feet plus 800 car parking spaces. The underlying land was our first acquisition outside of Shanghai back in 2005. Four plots acquired later – two in Shenyang and one each in Jinan and Wuxi – have all had their shopping centers completed. In fact Shenyang Palace 66 was completed over three years ago. Neither size nor construction complexity could be used as an excuse for Tianjin to be so slow. In fact, Jinan Parc 66 is similar on both counts. There could only be one explanation – the complicated and prolonged procedures in seeking various approvals from the municipal government.

Because of the delay, a huge mall associated with the local government opened some 18 months ago. Although its location, design and construction are all seriously inferior to ours, many top luxury brands are now housed there. It is for the time being the only game in town. For this reason, Riverside 66 will initially be akin to Shanghai Grand Gateway 66, i.e. a four-star mall comprising mostly sub-luxury names. However, our location is among the best in the city; the design is very beautiful, and our hardware is excellent. It is conceivable that one day the mall can easily be transformed into a five-star facility.

So far around 50% of the space has been leased, and I expect that by the third quarter, the figure should be over 90%. As always, we are targeting an initial gross yield of 4-5%.

In Hong Kong, we will continue to sell completed apartments as the market allows. What we have witnessed in the past three months is that there is pent-up demand. At the same time many developers are also eager to unload their inventory. Although not in a hurry to sell, at today’s price we shall be happy to part with them.

The luxury development, 23-39 Blue Pool Road, is near completion. It is the first residential project in the world to have received the Gold Level certification under the Leadership in Energy and Environmental Design (LEED) for Homes of the U.S. Green Building Council. We will primarily lease them out, but will also consider selling if the price is right.

As for our bread and butter business of property leasing, the Mainland market may remain slow for some time. For us, however, I anticipate better financial numbers this year due to improved operations. The teething problems at Palace 66 are basically behind us; Parc 66 will soon follow suit. As we all know, it takes one to two leasing cycles for a property to mature. Just as we have had a rolling schedule of opening one mall per year in the past four years, now one by one these malls will enter adolescence. This is always an exciting time of change which should bring improved results.

In our home market, I expect our rental properties to perform not unlike the year just reviewed.

I am gratified that over the years, this letter has received a warm reception from shareholders. As my faithful readers know, this Company has in the past two to three years undergone a tremendous management upgrade. I have been working closely on it with our Managing Director Philip Chen and I firmly believe that today we have a much better team which is prepared to tackle new realities. Yet more needs to be done.

Consider this: we are now a fast growing multi-location company. Since late 2010, our investment portfolio has grown from 13 million square feet to around 23 million square feet, and total rents received have risen from HK$4.8 billion to HK$6.6 billion. We used to be in two cities, now we are in five and will add one per year for the coming few years. To execute the construction and then leasing and management of the added space will require not only an expanded but also an improved team. Coupled with the aging of long-serving senior executives, we have out of necessity gone through a management rejuvenation process. A number have retired, and more have been hired and will be hired.

Philip and I did not for a moment underestimate the difficulties associated with such an exercise. Indeed the process could be painful at times. Nevertheless I believe that the most challenging part should be behind us. There is still the need to add to the squad especially as new projects like Wuhan are brought on board. All these efforts should enable us to realize the potential of the excellent strategy put in place by Philip’s predecessor. I am encouraged by what has been done and look forward to seeing better days ahead. There will always be market fluctuations like the lull of late, but as long as our strategic direction is proper and our management team is prepared – and now we have both in place – our future should be bright.