CHAIRMAN'S LETTER TO SHAREHOLDERS

Ronnie C. Chan

ChairmanRESULTS AND DIVIDEND

For the year ended December 31, 2014, turnover soared 86% to HK$17,030 million. Net profit attributable to shareholders jumped 62% to HK$11,704 million. Earnings per share rose similarly to HK$2.61.

When excluding revaluation gain, related deferred taxes and minority interests, the underlying net profit after tax nearly doubled to HK$10,022 million. Underlying earnings per share rose likewise to HK$2.24.

The Board recommends a final dividend of HK59 cents per share which is 1.7% higher than the previous year. If approved by shareholders, total dividend per share for the year ended December 31, 2014 will be HK76 cents, an increase of 1.3% over the previous year.

BUSINESS REVIEW

I told shareholders six months ago that I intended to lengthen the letter at mid-year while at times slightly shorten the year-end one in order to better communicate with them. In so doing, management thinking will be shared twice yearly in a more timely manner. A few shareholders, both institutional and individual, have expressed the value they place on this letter and their wish that the amount of information will not be diminished as a result of this change. I can assure them that they have nothing to worry about. The same effort will be given as before except they would now hear from me more fully on the same substance — economic and market analysis as well as company strategy — every six months instead of every twelve.

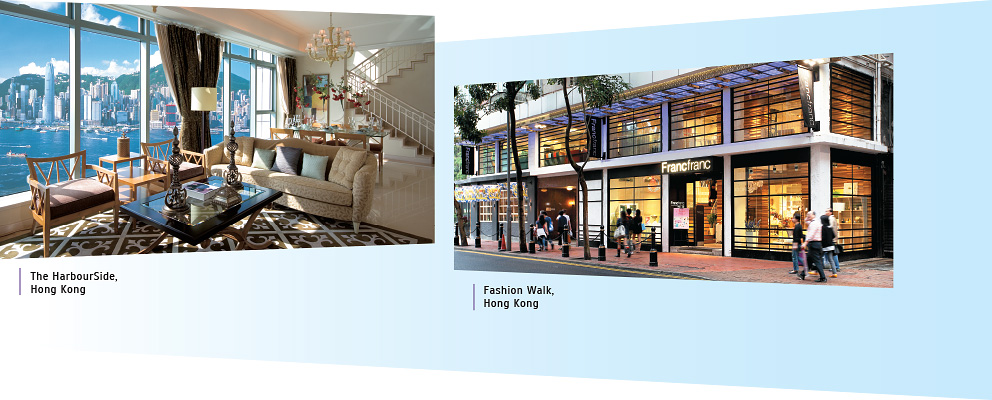

We recorded the highest turnover and underlying net profit attributable to shareholders in the history of the Company. Net profit attributable to shareholders was not the highest because of low revaluation gains. While our rental business performed barely acceptably, property sales in Hong Kong was strong. We took advantage of market opportunities and parted with 261 units at The HarbourSide and 151 at The Long Beach together with 93 car parks. All in all, we brought in about HK$9.8 billion. Profit therefrom was over HK$7.4 billion, yielding a blended margin of 76%. For The HarbourSide, the margin achieved was 78% and for The Long Beach, 62%.

With only 10 units and 153 car parks left at The HarbourSide, it is perhaps time to take stock of the events over the past decade or two. After the Asian Financial Crisis struck on July 2, 1997, property prices began to plummet in early 1998. A land sales moratorium was imposed by the HKSAR government. Once it was lifted in the spring of 1999, MTR Corporation, the railway company, was the first to sell land. As a pure property concern, we prepared well our finances before the crisis, and so we sat on a lot of cash. Only one other developer was in that enviable position. That company had non-real estate businesses which provided liquidity, although they incurred much loss in property developments. Consequently, they were perhaps psychologically less prepared than we were to buy land. We won auction after auction at very reasonable land prices.

The HarbourSide piece was the first, and subsequent events have proven the price to be the most reasonable, especially given the waterfront location with one of the world’s best harbor views.

When we first sold The HarbourSide apartments in 2004, the market was just recovering. The effects of the Asian Financial Crisis lingered until 2002, which was followed by SARS in 2003. Being financially strong, we saw little reason to hurry the sales program. Then a most amazing thing happened.

By 2004/2005, the effects of the Asian Financial Crisis and SARS had subsided. However, the government was determined not to release land for sale. For reasons given above, I could understand why it did so in the years between 1998 and 2004, but to continue for another 6-7 years was inexplicable. Some of us petitioned the government to release land but that fell on deaf ears. Without land supply, housing prices had nowhere to go but up.

We responded to this externality, which was totally out of our control, by withholding completed apartments from the market. We simply waited for the inevitable higher prices, as holding costs should not exceed the rate of value increase. Only in the past few years when the new government reversed its policy did we release the bulk of the units onto the market. The result was that profit margins kept rising until the last batch when it peaked at 78%.

We dare not say that prices for our unique harbor view apartments will not continue to rise. But as I had written two years ago, we should not be overly greedy, hence the parting of basically all the units. We also foresaw that the present government will sooner or later massively sell land to catch up, as higher residential prices have already become a huge social problem. This has now come to pass.

All told, the entire project of 1,122 units once sold out at today’s prevailing prices will bring a pre-tax profit of over HK$17 billion net to the Company. It is unlikely that I will in my career witness a more lucrative project. It was a convergence of factors, some within our control such as buying land at the right time and the decision to withhold selling, and others not, like erroneous government land policies, which have contributed to making this one of the most profitable real estate projects in the history of Hong Kong.

In local circles, there has been some public debate on the merits of our slow sales program. Different companies have different strategies and there is no single correct answer. Most firms treat housing development more or less as a production line. They buy raw material (i.e. land) in order to keep churning out products (apartments). They are not as keen as we are to time land purchase or apartment sales. Maximizing profit of any particular development is only one of their several considerations and may not be the chief one. Keeping the pipeline flowing to generate cash flow may be more important. We just happen to have a different strategy.

With very few new projects in Hong Kong, and judging that home prices would keep rising, we simply took our time selling The HarbourSide and The Long Beach. Our aim was to maximize profit and we have done well so far.

Our emphasis over the past decade has increasingly shifted to commercial property development and investment on the Mainland. We deem the Hong Kong property sales market to be less attractive and so we will only buy land when there are exceptional bargains. To be sure, we are not bearish about Hong Kong; we are constantly waiting for possible market changes which will lure us back. In the meantime, we are very busy constructing world-class commercial complexes for rent on the Mainland. We started to acquire land outside of Shanghai in 2005 and completed products began to hit the market in 2010.

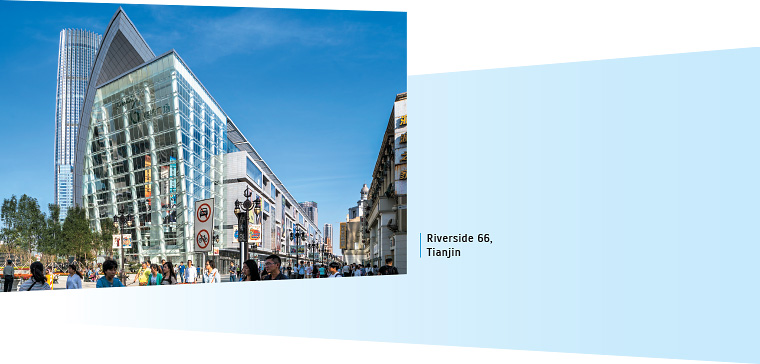

Let me turn now to our investment property business. Total turnover was over HK$7.2 billion — 46% from Hong Kong and 54% from the Mainland. In terms of operating profit, it was about 50/50. Overall rents received advanced by 9%, 6% in Hong Kong and 11% on the Mainland. If we exclude the two newest malls of Wuxi Center 66 and Tianjin Riverside 66, organic growth on the Mainland was 3%.

The 79-day Occupy Central protests in Hong Kong has hurt tenant sales. We are major property owners in two of the affected districts of Mong Kok and Causeway Bay. Shops have reported an 18% drop in business. As landlords, we are protected by property leases, but the impact on our innocent tenants was immediate. If the protests were allowed to continue, they would sooner or later affect our rental income. Fortunately they ended, and ended in a peaceful way.

The Mainland market had a different kind of challenge. Before analyzing our performance, let us first take a look at the overall economy.

Objectively speaking, the economic situation is not that bad. It is just that many foreign experts have, in recent years, somehow written China off because of its slower growth. Your management believes that there may soon come a time when they will be proven overly bearish. The present pessimism is in my opinion partly justifiable and partly misjudged. For example, local government debt and the weak residential market are both troubling, but neither has had a serious detrimental effect on the wider economy. These problems are not as big as some investors or analysts have thought. Yet many of them have oversold the market.

Consider some of the fundamentals. As the U.S. economy recovers, Chinese exports will follow suit. This will help work off some of the excess inventory. The process will be slow since Europe, traditionally the other major and in fact the biggest importer of Chinese manufactured goods, is not growing. The weakening yen will not boost exports to Japan in the near term. Hopefully Southeast Asia, Latin America, the Middle East and Africa will take up some slack. Overall, exports are steady and, in any event, growing faster than imports. Given recent oil price declines, China’s trade surplus will remain high.

Believing that excess liquidity, which is a legacy of the 2008/2009 trauma, has been substantially worked off, Beijing is once again loosening credit, albeit cautiously. Interest rates of late have been lowered. Public investments are running strong.

Unlike the first three quarters of last year, residential sales volume, and in some cases even prices, have of late risen nicely. So much so that in first-tier cities, land auctions are again breaking records. Full-year home sales, both in terms of total units and dollar amount, have surpassed those of 2013. Four months ago, few would have predicted this. By historical standards, the balance sheets of property companies are relatively healthy.

In this not-too-bad economic state of affairs, high-end consumption is a weak link. The effects of the continued anti-corruption efforts may yet last for some time. While lower price point products are easily sold through the Internet, sales of luxury goods are affected for the time being due to government policy. Since factors affecting our luxury brand tenants are not primarily economic but political, it is hard to predict when we will reach a “new normal”. We are definitely facing the most challenging years for our Mainland investment property business in 15 years. Two and a half years ago, I wrote that our industry would take longer to recover from the present downturn than it did after the 2008/2009 financial crisis. The prediction was correct, but the time to recovery might be even longer than we had expected. Frankly, we cannot see the end of it at this stage.

On the surface, our full-year results were quite acceptable. We saw rental growth in all but one mall. Careful examination, however, reveals certain concerns. What is critical here is to understand their fundamental causes, something which I will address later.

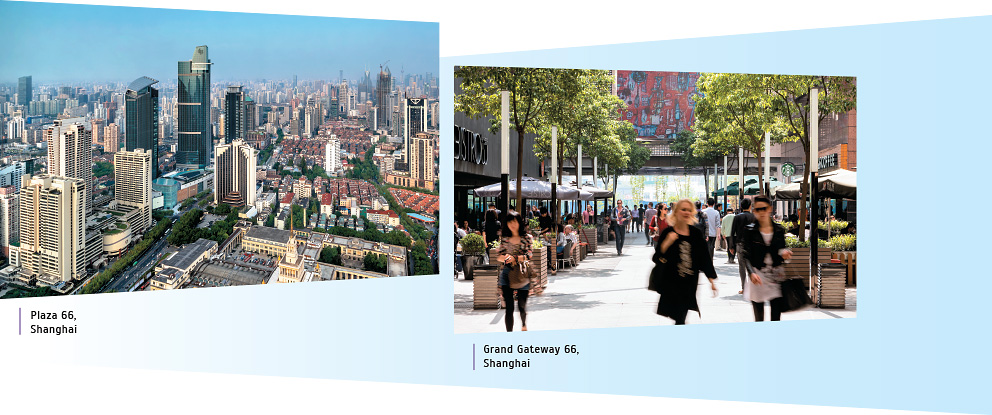

Rental turnover grew in all of our Mainland properties except one — Jinan Parc 66. In Shenyang, Forum 66 where rents increased, the rate has slowed down from the year before. In Shanghai, Plaza 66 held steady and Grand Gateway 66 went up a little, while in Shenyang, Palace 66 registered another rental growth at 4%.

With the exception of Parc 66, average unit rent went up in all our developments. Management however is cautious about the short-term outlook especially for Shenyang Forum 66 and the offices in Shanghai Plaza 66. In the latter facility, oversupply in Puxi, especially in our neighborhood, has put pressure on rent renewals.

In the newer malls of Wuxi Center 66 and Tianjin Riverside 66, occupancy is still rising as more shops commit. Those who have signed up are moving in. The two shopping centers in Shanghai are fine while Palace 66 will improve further. Parc 66 and Forum 66 are struggling a bit, while Center 66 will continue to find its optimal tenant mix.

Rental margins in non-mature facilities (i.e. those outside of Shanghai) have yet to improve. Marketing expenses and other costs related to a newer mall are still necessary, and it will take the second lease cycle to gradually improve.

Tenant retail sales showed a mixed picture. Palace 66 grew by 12% but Plaza 66 fell by 4% and Parc 66 by 2%. Grand Gateway 66 and Forum 66 both improved slightly.

Footfall numbers also vary from mall to mall. Parc 66 is an interesting case: while results above indicate that it is still undergoing teething problems, the number of visitors is holding up. This means shoppers are spending less, which is the case almost everywhere in the country.

Recent public information on global luxury brands confirms a difficult trading environment. Hardly any of them did well in China. This is different from fast retailing which has performed much better.

An area where management was somewhat pleasantly surprised was office leasing in Wuxi Center 66. The first of the two towers has a gross floor area of almost 90,000 square meters. When it opened during the fourth quarter of last year, occupancy stood at 29%. Now about 50% of the space is committed. The number is expected to climb further in the coming months. Rental rates are acceptable.

The first office tower in Shenyang Forum 66 is much larger, a gross floor area of over 191,000 square meters, of which slightly less than 50,000 square meters will be a 5-star hotel. We are now in final negotiations with international hotel management chains. When the office portion opens later this quarter, it is expected to be 20% committed. Rents are slightly higher than those in Center 66.

As to the unleveraged gross rental return on investment cost, the two Shanghai properties achieved 44%. In Shenyang, Palace 66 improved to 5% and Forum 66 between 9 and 10%. Jinan Parc 66’s rental yield was between 7 and 8%, and Wuxi Center 66 over 9%. When the first Wuxi office tower is fully leased, the blended number for the entire development should be around 6-7%.

In terms of tenant mix, the two mature Shanghai malls have experienced a phenomenon considerably different from the other centers. As I have previously written, on the Mainland, luxury brands continue to concentrate in fewer stores and locations. For example, at Plaza 66, Chanel, Celine, Tod’s and Escada have just completed their expansion plans, while Prada and Bottega Veneta are underway. As for our newer 4-star malls, we are bringing in more non-conventional shops, entertainment outfits and lifestyle luxury names. Jinan Parc 66 is a prime example and management expects an improved performance not unlike what Shenyang Palace 66 has experienced in the past two years.

Our financial position remains extremely strong. The Company is basically debt-free (i.e. zero net debt) at year end for the ninth consecutive year except 2013. During that period, we have committed to invest some HK$92 billion in new projects on the Mainland (i.e. everything outside of Shanghai), of which approximately 54% has been expensed. This may be unheard of anywhere in the real estate industry. Yet the magic of a volatile and extraordinarily high unit price environment of Hong Kong coupled with the huge and fast-evolving market of the Mainland have made this possible.

I consider it my great fortune to be in this sector for the past twenty-some years to capture this once-in-a-lifetime opportunity. To top it off, vacillating market sentiments notwithstanding, no other economic phenomenon will be more certain than the continued rise of China’s consumers. This plays well into the mainstay of our business. The solid foundation we have built over the past two decades should carry the company forward powerfully.

PROSPECTS

It is not easy to foresee a situation where government policy or market forces will significantly change the retail scene in both Hong Kong and the Mainland. As a result, it is safe to expect a rental prospect for the coming year to be similar to that of 2014.

We still have 708 units at The Long Beach which remain unsold. Market sentiments permitting, we will sell what we can. The same goes for the remaining units at The HarbourSide and elsewhere. If the price is right, we can also part with the 18 highly coveted luxury homes on Blue Pool Road. However, we are not in a hurry. Unlike low unit cost products, the price for deluxe housing can be very elastic. As before, we look to maximize profit.

If we manage to sell out all of these, turnover and profit may surpass that of 2014. This, however, is not a realistic prospect, which means this year’s profit will likely be lower than that of the year under review.

Next, I want to discuss the important subject of changes in management orientation to meet evolving market conditions. However, I will take an approach which my loyal readers know is atypical of me. I will first review our share price which is the main concern of investors but less so of management. As I have always maintained, we are here to manage the Company and not share price movements. I am a firm believer that as long as the Company is strategically sound, operationally healthy and sustainably profitable given acceptable risks, its stock price will sooner or later reflect reality.

When Hang Lung Development, the predecessor entity to our parent Hang Lung Group, was first listed on the Hong Kong Stock Exchange in 1972, we had one of the biggest market capitalizations among all local real estate companies. In the ensuing two decades, we underperformed because of over-conservatism which led to strategic mistakes and missed opportunities. By the time I took over the chairmanship in January 1991, we were way down in the size-league table of local developers.

The 1990’s was a time when then new Managing Director Mr Nelson Yuen and I strived to reorient the business. Many changes were introduced which led to what almost became a brand new company. For one, we led the firm into mainland China. We also timed the market in Hong Kong and tried to avoid making serious mistakes. We took every opportunity to strengthen our financial position and waited for the big break. Opportunity finally came in the form of the Asian Financial Crisis in 1997-2002, and we capitalized on it well.

Before the early 2000’s, very few equity analysts covered our stock. By around 2003, our share price began to rise. We became the darling of many analysts and institutional investors. With the exception of 2008 during the global economic crisis, we had an almost uninterrupted run of some eight years until early 2011. Since then we have slightly underperformed in the sector. A year ago, I wrote about its causes and will expand on them later.

In any event, at the beginning of the millennium, our Mainland strategy, then limited to one city, together with our Hong Kong maneuvers began to pay off. Initial success in Shanghai has blazed the trail for second-tier cities since 2005. We purchased some of the best commercial land at among the lowest unit prices in the industry. In Hong Kong, we bought land at the bottom of the market and turned these projects into some of the most profitable the city has ever seen.

Also worth mentioning is that we paid high prices for our two pieces of land in Shanghai. We bought them at the top of the market and it took 10 years for prices to return to costs. Nevertheless, it might not have been a mistake since similar excellent plots would not have been available for purchase at market bottom. The completion of the two developments also coincided with the demand for luxury goods taking off in the country and we caught it perfectly. Was that luck or brilliance of management? I think it was more the former.

It was obvious that our success in Shanghai was not because of buying land on the cheap. Frankly, unlike residential development for sale in Hong Kong, land price should not be the deciding factor in the success or failure of a commercial property investment project on the Mainland. The reasons are two: construction is more expensive than land, and consumer spending is rapidly rising such that rents will follow suit. Buying the wrong plot, such as in a poor location, is far more serious than overpaying for the right piece. We did the latter in Shanghai. In more recent years, all land acquisitions in second-tier cities were right and inexpensive.

Why then did our share price remain stagnant for the past four years? A year ago I suggested both exogenous and endogenous factors which are still valid today. Here I want to expand on an important point which deserves further attention. Namely, we have grown so fast since 2005 that the management team, despite having expanded rapidly in the past decade, has had a difficult time catching up.

Consider the following statistics: in less than five years from mid-2010 until now, our Mainland rental portfolio has grown by 3.5 times. Rents collected have more than doubled, rising from HK$1.9 billion to HK$3.9 billion. On average we added over 300,000 square meters per year of world-class commercial properties, which, as I have said before, is larger than one New York Empire State Building. If we continue to move forward at the same rate, it will take another decade to exhaust the existing land bank. I suspect few developers anywhere can match this magnitude of growth.

Likewise, staff count has climbed as a result of business expansion. In the same five-year period, the number of executives who received stock options has increased by 3.2 times. Once we started to buy land outside of Shanghai in 2005, we have begun to enlarge the team. Counting Hong Kong-based executives alone, we doubled the number in the first six years. Since opening our first mall outside of Shanghai in 2010, we have seen a 2.5 times increase in the past four years.

Constant influx of new executives notwithstanding, it seems we are unable to meet the ever-growing demands. What made it doubly hard was the departure of our long-serving Managing Director. Eighteen years prior, Mr Nelson Yuen had informed me personally that he would retire in 2010 and had reminded me of it in 2008. As such, I could hardly fault him for the timing. Fortunately, he and I together with the strong guidance from the Board have found a most capable successor in Mr Philip Chen. Philip joined in July 2010.

Yet challenges seemed never-ending. Around that time, we had a number of long-serving senior staff who reached retirement age or otherwise resigned. Much more troubling was the need to replace several of our senior executives, a subject which I had previously reported. Management orientation at that time was evolving from a strategy-intensive focus to an operation-intensive one. Among other things, resistance to change had to be stopped and top management had to do what had to be done. Those tough decisions were resolutely taken. Since Philip had only just joined us, I had to personally step in to execute some of those key changes. Having spent much of his earlier career in the airline industry, Philip put it best: it was like we had to change the plane’s engine in mid-air!

Consider the following: not counting the retirement of Mr Nelson Yuen, in the 3.5 years prior to January 2014, we saw the departure of four director-level executives, three of whom were long-serving. At the next level of management called Assistant Directors, we saw the departure of six, of which only one was due to retirement. Among the four current director-level executives, I am the only one who has held the same position for more than 4.5 years. Of the present twelve Assistant Directors, only one predated Philip.

Almost all of these personnel changes were necessary. Although we have been hiring all along, the expansion rate of our operation was overwhelming, resulting in a lack of bench strength to support organizational growth. Our management team was stretched to the limit.

Finding very senior people is never easy. If nothing else, it takes time. Of the three major functional heads in areas of finance, construction and leasing, only the first was internally promoted; the other two had to be hired externally. Construction involves huge sums of money and many mistakes can have devastating financial and reputational consequences. We are fortunate to have finally engaged several highly qualified professionals. Teams have been built under them and are performing satisfactorily.

In the longer run, however, leasing is our bread and butter. This is an area where we are still struggling. Unlike construction which can bring catastrophic and sudden troubles, inadequacies in the leasing team will sow seeds of problems that may take years to reverse. This, I believe, is the crux of our present challenge. Tough market conditions aside, a shortage of experienced hands in the past few years has been the source of our struggle.

It was not for the lack of trying, but we do not always get the personnel issues right. A mistake can potentially cost us 2-3 years. Fortunately, we have found a pair of experienced hands in our Leasing Director. Even so, building an adequate team under him is still a challenge. A lot has already been done but much more is required.

Until we fix this problem, our performance will be affected and this will be reflected in our share price. Management is keenly aware of this, and we are doing our best to build a team of operational excellence.

How much longer will it take to build up our leasing team? My estimate starts at two years. Once accomplished, our Company will thrive again. My optimism is grounded solidly on the nature of high-end shopping center business. Namely, the single most critical factor for success is the hardware, or real estate “genetics” as I have called it — location, size, design and construction. They are the most critical because once determined, they cannot be changed. Lacking any of the four elements may permanently remove that facility from the competitive race. There is no room for failure in getting the hardware right. Fortunately all of our properties have all four success factors.

What about software such as management and corporate culture? Management is of course very important. A shopping center with excellent hardware complemented by a strong team will ensure its top spot in the market. Shanghai Plaza 66 has so far achieved that status. A mall that has superb hardware but lacks adequate management will still perform acceptably, but it will not realize its potential. It will also leave room for competitors to exploit. And if management is weak over a prolonged period, the facility will gradually lose its competitiveness. However, it will unlikely die a sudden death. But even in such a case, a change or improvement in management should be able to revive the property because of its superior hardware.

Then there is the case of poor genetics. If it is bad enough — and many malls in China are — even the best manager will not be able to salvage it. To put it bluntly: a short man (i.e. one with the wrong genetics) can never play basketball — at least not in the major league, and we are only interested in the major league.

Looking at the competitive landscape, there are very few shopping centers in China which have good, let alone excellent, hardware. Yet few will dispute that your Company has some of the very best. We are now working hard to build the best software — management — to match it. We already have it in finance and construction. The only area that needs work is the operation of rental properties. We will get it right.

For fear of being accused of overstating my case, let me quickly add that we do have many competent staff in managing investment properties. Our success in Hong Kong and Shanghai over the long years was certainly not built on luck, for luck by definition cannot be with us over a prolonged period of time. It is just that our rate of business growth is unprecedented and for reasons given above, we find ourselves short-handed. I am confident that on the basis of what we already have, we can build a first-class team to match our world-class properties.

A few years ago I wrote about corporate culture. Traditionally, Hang Lung is a company with a very strong culture. But as we expand, it was difficult to maintain, let alone strengthen it. When we added Shanghai and became a two-city organization, frankly we began to dilute it. Over time, counterproductive systems and norms began to set in. This was a major reason for the difficulties experienced some five years ago as I have earlier described. At the same time, we were expanding at a rate of one new city per year with a shortage of experienced staff. One can imagine the speed with which even a long-established corporate culture can be strained.

As we are now building out our team, corporate culture is an area which management must revisit. It needs to be reaffirmed, strengthened and propagated throughout the organization. This is now being executed although much more work is needed. No corporation can have sustainable success without a proper culture.

Some analysts think that oversupply of retail space is our main woe. To a good extent, I disagree. The fact is that in each of our second-tier cities, our luxury malls usually have at most one direct competitor, and there is room for at least two such facilities. As for our sub-luxury shopping centers, there are usually no more than two direct competitors, but the market can absorb many. As always, our stated goal is to be the very best in each market in which we play. All things considered, each of our malls is already number one or at least number two in their respective markets.

On a slightly lighter note, I should say a word about our Company logo. It relates to what I have just discussed. People have expressed to me its elegance but I have never explained to shareholders its meaning, although it has been in use for 22 years.

For the first 33 years of our history — Hang Lung was founded in 1960 by my late father Mr T.H. Chan — we only used a particular rendering of the two characters of our Chinese name. It looked solid if not a little heavy and old-fashioned. Recognizing the need for a new logo in an increasingly globalized world with shareholders from many parts of the world, I, in the third year of my chairmanship, engaged a design firm. The first time I saw our current logo, I picked it from among many alternatives. I considered it both elegant and meaningful.

First, the two groups of three columns each linked by a flowing ribbon form the alphabet “H” as in “Hang Lung”. Columns or pillars denote solidity and are emblematic of our real estate industry. At that time, because of the old Hong Kong Kai Tak Airport, buildings were limited to 20 storeys on one side of the harbor, the Kowloon side. So Kowloon is represented by the flat top on the right side of the logo, while Hong Kong Island, without such restrictions and hence having much taller buildings of varying heights, is represented on the left side of the logo.

Second, the ribbon denotes the software which ties the six pillars of hardware together. Strategy, construction, and finance are examples of hardware, while management and corporate culture represent software. The best hardware together with the best software will make our business thrive.

Within the Company, we have some very promising young staff in their 30’s. Many of them will likely be with the Company for the next 20-30 years. They have inherited the best hardware in the industry. This is a legacy of decades of sound strategy and hard work. As the young future leaders gradually step to the fore, they should realize that for the Company to move forward and maximize its potential, different critical skills will be required. In the foreseeable future, operational excellence will be the key.

As we transit from concentrating on strategy, land acquisition and building design to building out the land bank and leasing and managing the space, future leaders of this Company must know how to run a tight ship. As long as we do this well, our future is rather secure for many years to come. We will ride the rising tide of consumerism in China, and expect to become a big beneficiary.

In times of transition like this, someone like Mr Philip Chen is critical. If he can successfully run a complicated business like an airline and help make it into one of the world’s most profitable, he can surely manage a real estate concern. He knows how to build an efficient organization. What he and I have to do in the next 2-3 years is to build the top management team with people who can succeed us. The process has in fact started four years ago and I look forward to seeing it bear fruit.

Of more immediate concern to shareholders are two issues: when will the Chinese consumer market recover, and when will Hang Lung share price rise again. Although I do not know the answer to either, let me nevertheless share with my readers how I see the future.

As I said earlier, the present downturn for luxury goods may take some time to recover, or to find its “new normal”. In the interim, we will finish building our management team, especially on the leasing side. Once done, if the market has not yet recovered, we will simply sit tight and wait. Nothing is more certain on the Mainland than the rise of consumption in the medium to longer term. While we wait, we will resort to hunting more land. So far we have done superbly in this regard and there is no reason to believe that we cannot continue to do so going forward.

Sooner or later the stock market will recompense us for all the right things that we have been doing. Between 1991 and 1997, we waited and were hugely rewarded in Hong Kong when the Asian Financial Crisis came. Now we shall wait again while building a team that can take great advantage of China’s rising consumerism.

To achieve all this, we need a blue-ribbon Board. We have one, and I am proud of it. While not yet perfect in corporate governance, our Board is nonetheless by far the best in the industry in Hong Kong by many measures. I firmly believe in this, and will challenge anyone who questions it. For example, I know of none of our peers whose Independent Non-Executive Directors wield so much power in critical company affairs as ours do, nor work so diligently to fulfill their obligations.

This has been true for well over a decade. Perhaps due to lack of self-marketing — or rather, others promoting themselves better than we have in this regard — for years we did not catch the attention of experts who survey companies on corporate governance. But as is always my belief, as long as we do the right thing each step of the way, sooner or later the market will recognize us. This is true of our governance standard and our stock price.

In terms of corporate governance, in recent years we have more often than not garnered most of the top awards for our industry. Certain practices on which we alone have for years insisted, such as announcing interim and final results within one month of financial period end, have now been adopted by certain competitors who have previously vehemently resisted them. We are pleased to contribute to the improvement of corporate governance in the property sector.

As to our share price, we saw a rerating in the 2000’s after a decade of doing the right things. My belief is that it will happen again for we have again been quietly preparing the Company for the next wave of growth.

It is with mixed feelings that I announce the retirement of two long-serving directors Mr S.S. Yin and Dr H.K. Cheng. They serve on the Board of this Company and of our parent Hang Lung Group. Both gentlemen have expressed their desire to not stand for re-election of the Hang Lung Group Board at its coming Annual General Meeting on April 29. As a result, they will also step down from this Board. On behalf of all my fellow directors, I thank them for their long years of loyal service.

A banker by training, Mr S.S. Yin is a former Executive Director and later Managing Director of the original Hang Lung entity called Hang Lung Development Company, Limited founded in 1960. He joined in 1971 when the Company was preparing to go public the following year. Since his retirement from active management in 1992, he has served as Non-Executive Vice Chairman of this Company and of Hang Lung Group.

Dr H.K. Cheng, a distinguished engineer and civic leader, joined as Non-Executive Director in 1993. He ably chaired committees and hardly missed any meeting — exemplary to all of us!

Fortunately, another equally distinguished engineer joined our Board last October. Before retirement last year, Dr Andrew Chan was global vice chair of the world-renowned London-headquartered multi-disciplinary engineering firm, Arup. Not only is he most experienced in his profession, he is also a dynamic thinker. His out-of-the-box thinking always blends pragmatism of an engineer and creativity of a business leader. It is indeed our good fortune — for both management and shareholders — to have Andrew as a director. I look forward to working with him in the years to come.

The Board has agreed upon certain guidelines for tenure of directorship. They relate to term limit and age limit. While not set in stone, they are nevertheless useful to help direct future actions. In my opinion, there are no hard and fast rules to handle these issues. Any model adopted must take into account many factors and strike a balance. Being dogmatic is unwise, just as it is imprudent to not have reasonable guidelines. I refer readers to my letter to Hang Lung Group shareholders for further discussions.

Ronnie C. Chan Chairman

Hong Kong, January 26, 2015

ADDENDUM TO CHAIRMAN’S LETTER TO SHAREHOLDERS

To Our Shareholders:

It gives me pleasure to announce that Professor H.K. Chang has joined our Board as an Independent Non-Executive Director. This took place after my latest letter dated January 26.

H.K. is a distinguished engineer with an extraordinary breadth of knowledge of the world. Over the years, he has successively served as professor, deans of schools of engineering and finally president of City University of Hong Kong from which he retired in 2007. Having grown up in Taiwan, and educated and worked in the United States, H.K. finally moved to Hong Kong in 1996 where he now calls home. He serves on the boards of some of our city’s biggest companies. He lectures in many universities around the world including China. I look forward to his many contributions.

Professor Pak Wai Liu, an Independent Non-Executive Director, has agreed to join the Board of Hang Lung Group Limited with the understanding that when his term at the Company is expected up in 2016, he will not seek re-election. As records show, since 1997, we have not appointed Non-Executive Directors who serve on both Boards. This practice will continue.

Ronnie C. Chan Chairman

Hong Kong, March 11, 2015