HONG KONG PROPERTY

Through thoughtful consideration, tenant mix optimization and vigorous asset upgrades, Hang Lung further strengthened the overall performance of the Hong Kong portfolio and succeeded in generating stable growth despite the uncertainties in the economy.

Government measures to cool down the property market suppressed property transactions in the year and discouraged owners from selling their properties. This, in turn, affected consumer sentiment and the sales performance of some of our anchor tenants.

Nevertheless, the occupancy rates of our retail and office properties both increased by two points to 98% and 96%, respectively.

With positive rental reversions during the year, we achieved growth in rental turnover and operating profit by 10% to HK$3,112 million and 11% to HK$2,643 million, respectively, when excluding the impact of the discontinued operations. Overall, rental turnover and operating profit rose 3% and 5%, respectively, compared to a year ago.

For 2014, we expect sustainable growth in tenant sales and rental turnover despite the predicted economic uncertainty. We also believe that the prime locations of our commercial and retail properties, together with our continuous efforts to improve our tenant mix and service quality, will have a favorable impact on our growth picture in the year ahead.

COMMERCIAL

Despite the slow market growth in 2013, rental turnover of our shopping mall business increased 7% to HK$1,726 million. The overall occupancy rate also recorded a rise of two points to 98%.

The Peak Galleria has been performing well after Chow Tai Fook, Sa Sa, Coach and Tommy Bahama joined the mall. These businesses not only contributed to our strong rental situation, but also increased sales within the mall and improved the overall shopping experience.

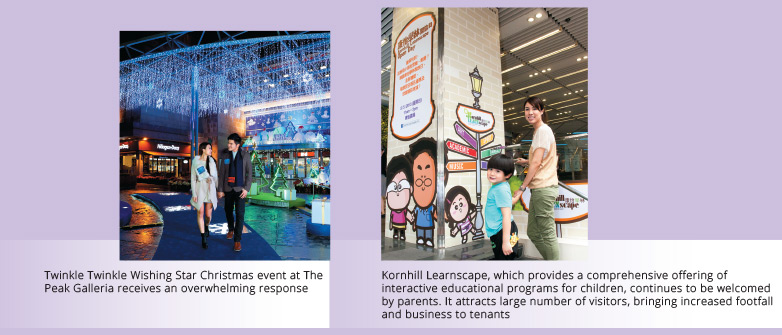

What’s more, bringing in stores with a unique local story such as Hong Kong Trams Station, Cookie Galerie and Tai Cheong Bakery increased media exposure for the mall and strengthened our Love Hong Kong Style branding. To maximize the potential of its unique location, The Peak Galleria joined with the Peak Tower and the Hong Kong Tourism Board for the first time to organize the Twinkle Twinkle Wishing Star Christmas event, which was well received by the public.

Supporting our vision to reshape Fashion Walk as a “distinctive lifestyle destination” for affluent and sophisticated fashion or food lovers and trendsetters, progressive tenant mix improvements continued to take place in 2013. New brands such as COS, Francfranc and King Ludwig German Restaurant have been introduced and they were all well received by our target customers. Novel pop-up stores including droog and GumGumGum, complemented with a bustling schedule of promotional activities and social media efforts, further engaged shoppers with our area brand and injected exciting energies into Fashion Walk.

A lease agreement was signed with H & M Hennes & Mauritz AB (H&M), one of the world’s largest fashion retailers, which will open its first Asian and the biggest global flagship store at Hang Lung Centre in the summer of 2015. This will undoubtedly add to the strength and attractiveness of our retail portfolio in Causeway Bay, reinforcing the transformation of Hang Lung Centre and Fashion Walk as a retail and entertainment hub in the district.

Kornhill Plaza remained almost fully let throughout the year of 2013. This was in large part due to a major upgrade of the mall’s restaurant businesses in 2012, as well as various promotional functions and activities that enhanced the shopping experience of customers. As a result of these promotions, the mall was able to improve sales performance and achieve remarkable growth.

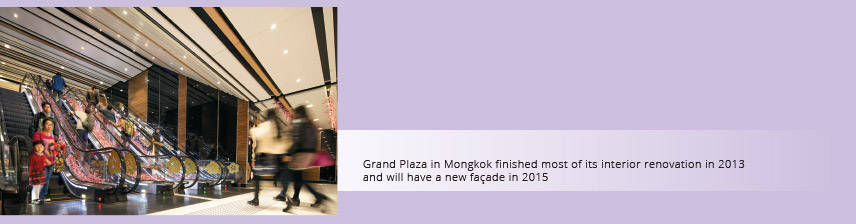

The interior renovation of Grand Plaza was mostly completed during the year, which contributed to an outstanding rental turnover growth of about 22%. Work is now proceeding to complete the façade, which is scheduled for completion in the first quarter of 2015. Further improvements in the tenant mix are planned for the year ahead, with new duplex shops becoming available in the future.

The growth in tourism numbers, particularly of mainland Chinese tourists with medium range of spending power, will continue to be a dominant theme in the coming years. Our positioning of Grand Plaza is designed to match the profile of this important group of customers.

We completed a tenant reshuffle at Amoy Plaza during the year, replacing the original F&B tenants with young and energetic fashion brands and cosmetics retailers who have the ability to pay higher rents. Together with the satisfactory rent reversion rate upon tenancy renewals, the overall rental turnover increased by 9% in the year. Another major tenant upgrading plan is currently making good progress, which we believe will further contribute to higher sales growth in the mall.

OFFICE AND INDUSTRIAL/OFFICE

During the year, we increased total rental turnover in our office and industrial properties by 10% to HK$983 million on a comparable basis and maintained a high occupancy rate of 96%.

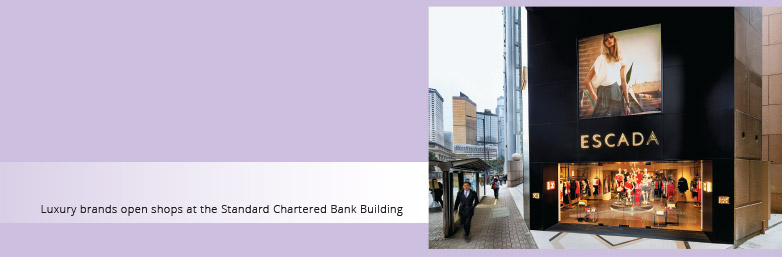

At the Standard Chartered Bank Building , the office units have been fully let since October 2012. We have also leased all the shops in the commercial podium of the building. Among the new tenants acquired during the year were Escada, a luxury fashion brand with many loyal and upscale customers, and Mott//32, a modern high-end Chinese restaurant.

Opening in the first quarter of 2014, both tenants will enhance the building’s image as a Grade A office tower in the central business district. They will also create greater synergy with other shops in this exclusive area of Hong Kong.

Our major tenant, Standard Chartered Bank, set up its first digital branch in Hong Kong at the Standard Chartered Bank Building. Featuring a stylish façade with a giant TV, the digital branch brought a completely fresh look for the building.

The rental situation in the central business district softened in the past year, following a year of aggressive expansion by international retailers along Queen’s Road Central in 2012. They are now looking for less prime alternatives in the area, due to high rents on Queen’s Road Central and a lower-than-anticipated sales performance. Against this backdrop, we expect stable income growth for our commercial and office leases in the Standard Chartered Bank Building in the year ahead.

A new F&B tenant, Duddell’s, which was just awarded a Michelin One Star, has been introduced within the Shanghai Tang premises at 1 Duddell Street in 2013. Overall our strategic leasing and marketing initiatives aiming to strike a balance between pure office and non-office tenants succeeded in generating moderate growth among the buildings in the portfolio of Duddell Street. Taking advantage of the coming lease expiry, we are also planning for a tenant mix upgrade in the commercial segment of Printing House and Baskerville House, which will also help to enhance the overall shopping environment of Duddell Street and bring a synergy effect to existing tenants.

The educational concept of Kornhill Learnscape at the Office Tower of Kornhill Plaza has been well-developed and has gained a good reputation in the community, creating a synergy effect with the shopping mall by attracting more shoppers, maximizing the business potential of the whole portfolio.

Rental turnover of Office Tower One of Grand Plaza recorded steady growth in 2013. This was attributable to the medical and beauty trades which have a higher rental affordability compared to tenants of pure office use. We will continuously enhance these theme zones by upgrading the hardware as well as the professional management services to our tenants and customers.

RESIDENTIAL AND SERVICED APARTEMNT

The overall occupancy rate of our residential and serviced apartments dropped by one point to 74%, but total rental turnover during the year still recorded an increase of 1% to HK$285 million.

PROPERTY DEVELOPMENT AND SALES

We build top quality residential properties in prime locations and take a highly disciplined sales approach to optimize value. As a result, our properties are normally well received in the market.

In 2013, however, the property market slowed down due to the uncertain global economy and the Hong Kong government’s cooling measures, which caused a drop in the number of buyers from mainland China and overseas.

Total proceeds generated from the sales of The Long Beach, The HarbourSide and AquaMarine in 2013 amounted to HK$2,500 million, up by 96% compared with the previous financial year.

THE LONG BEACH

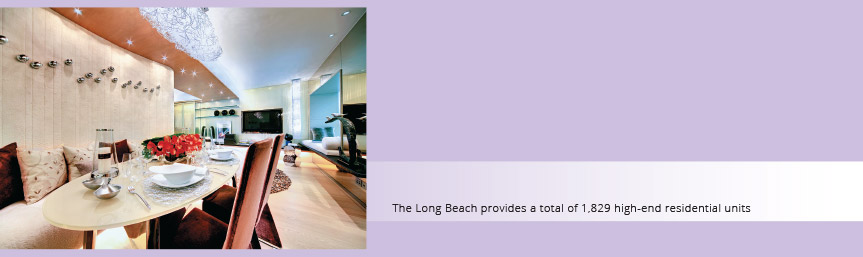

With a prime location in southwestern Kowloon, The Long Beach is a high-end residential complex with a total of 1,829 units in eight towers. Distinguishing features include a unique wave-like design, spectacular sea views and a best-in-class clubhouse with four stories of luxury facilities and recreational services.

In 2013, we sold 267 units and the profit margin on the total sales of HK$2,417 million was 60%.

THE HARBOURSIDE

Soaring above Kowloon Station, The HarbourSide is a prestigious, top-end residential development in a prime location in southwestern Kowloon.

The complex has a total of 1,122 units in three connected towers, with sweeping 180-degree views of Victoria Harbour, an ultra-modern design and contemporary lifestyle facilities.

During the year, one unit was sold with total proceeds of HK$53 million.

23-39 BLUE POOL ROAD

23-39 Blue Pool Road in Happy Valley is a luxury development in a prime location, covering a site area of 7,850 square meters. It was awarded a Gold Level certificate under the Leadership in Energy and Environmental Design (LEED) for Homes launched by the U.S. Green Building Council. So far, it is the largest project in China to gain the certification and the first project in the world registered under the International Pilot Scheme.

The project also gained a Certificate of Excellence in Architecture (Best Residential) in the professional category at the 10th Perspective Awards in 2013.