Financial Reporting

In a landmark decision testifying to our dedication to good corporate governance, we announce our interim and final results within one month after the end of the financial periods.

Moreover, the Board endeavors to ensure a balanced, clear and coherent assessment of the Company's position and prospects in annual reports, interim reports, inside information announcements, and other disclosures required under the Listing Rules and other statutory requirements.

Risk Management and Internal Controls

The Board has overall responsibility for the risk management and internal control systems of the Company, in addition to evaluate and determine the nature and extent of the risks it is willing to take in order to achieve the Company’s strategic objectives. The Audit Committee supports the Board to oversee the effectiveness of our systems on an ongoing basis.

Management is tasked with the design, implementation, and maintenance of a sound and effective risk management and internal control framework with reference to the COSO (Committee of Sponsoring Organizations of the Treadway Commission) principles, which is crucial in bringing corporate strategies to fruition and ensuring the sustainability of the Company. Like any others, our systems are designed to manage rather than eliminate the risk of failure to achieve business objectives, and can only provide reasonable and not absolute assurance against material misstatement or loss.

Risk Culture

The Board recognizes that a strong risk culture is essential for effective risk management and long-term sustainability. We foster a culture where risk awareness and accountability are embedded across different levels of the organization and aligned with our vision and mission. Risk considerations are integrated into our strategic planning, decision making, and daily operations of our business activities including leasing activities, and property management.

Through ongoing training, open communication, clear policies and procedures, and regular assessments, we reinforce a proactive approach to risk management. These systematic actions enable us to navigate uncertainties with resilience and deliver sustainable value to our stakeholders.

Risk Appetite

The Board has overall responsibility for risk management, including determining the nature and extent of risks the Company is willing to take in pursuit of its strategic objectives. We embrace calculated risks that drive performance and support sustainable growth, while committing to the zero tolerance for unethical behavior. The Company has established a risk assessment matrix, approved by the board, to evaluate and prioritize risks in accordance with our defined risk appetite. Principal risks are reviewed and assessed at least annually to ensure that appropriate mitigation measures are in place and that overall risk exposure remains within appropriate and acceptable level.

Risk Management Framework

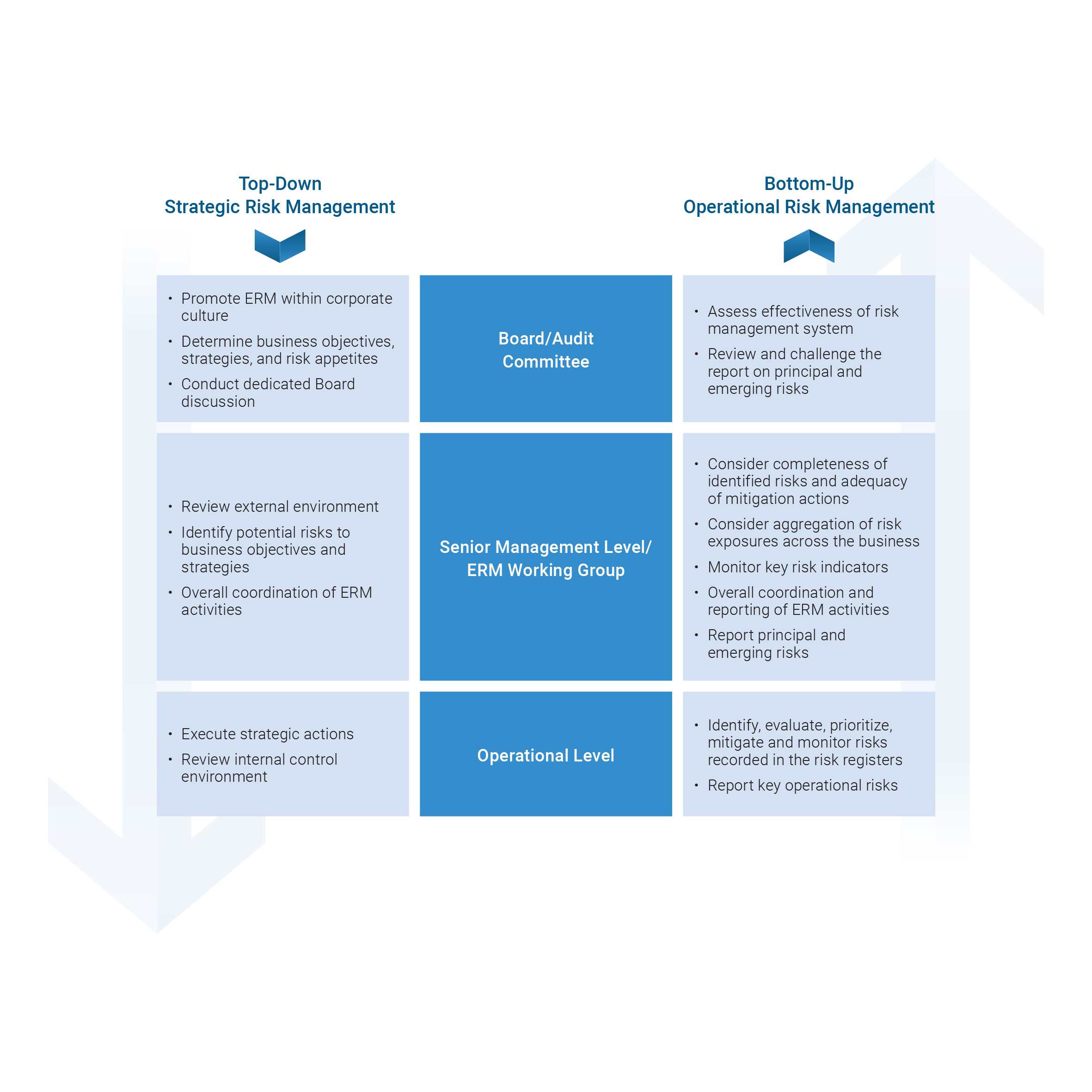

Our risk governance structure is guided by the “Three Lines Model.” As the first line functions, risk owners of all corporate departments and business units regularly conduct risk and control assessments in the day-to-day operations to evaluate the implications of respective risks identified and the adequacy and effectiveness of actions in place to mitigate these risks.

As the second line, specific functions are established to effectuate risk management and ensure the first line is performing properly. The responsibilities of these functions include but are not limited to financial controls, risk management, legal and compliance, as well as cost and quality measures. Under its approved terms of reference, the Enterprise Risk Management (“ERM”) Working Group (comprising our CEO as Chair and unit heads from major business units and support divisions) oversees risk management activities across all functions and makes a robust assessment of the principal risks and uncertainties that the Company is exposed to.

As the third line, the Internal Audit Department plays a crucial role in assessing the effectiveness of the risk management system, reports regularly to the Audit Committee on key findings, and provides recommendations for improving and tracking the implementation of such measures.

The Board and the Audit Committee reviewed the Company's principal and emerging risks and conducted an annual review of the effectiveness of the ERM framework. Taking into consideration principal risks and mitigation actions, the Board believes the Company has the ability to adequately respond to changes to our business and the external environment.

Risk Management Process

The Company adopts a proactive risk management process which is fully integrated into our daily operations. This enables risk owners to identify, assess, treat, report and monitor significant risks arising from our business and the constantly changing business environment at different levels within the organization. This integrated approach combines a top-down strategic view with complementary bottom-up operational processes, as illustrated below:

.png)