The Future of Hang Lung

"Compared to us, our successors are more fortunate."

Last year, Ronnie talked about the Company's succession plans for the first time, and in March this year the Company announced the appointment of the new CEO.

He said in his latest Letter, "It makes sense to have more younger and tech-savvy people on the Board." When asked if Mr. Weber Lo, who will join Hang Lung in May, is the type of person he was referring to, he answered, "Although Weber is only 47 years old, he has already gained over 20 years of management experience from P&G, Coca-Cola and Citi Bank. I think this is important for the Company."

Recalling the situation of the Company back in 2010, Ronnie said, "The situation is totally different now. Back then there was a very high level of uncertainty when compared with that of today." The uncertainties that Ronnie referred to included the changes in management and the expansion of the Company's business to eight Mainland cities within eight years. He added, "The Company built more properties which of course boosted our leasing business, yet that also led to a high level of operational uncertainty. The years (20)09, (20)10 and (20)11 were the most uncertain times. Under the leadership of Philip (CEO Mr. Philip Chen), we have worked very hard over the past eight years to tackle these issues."

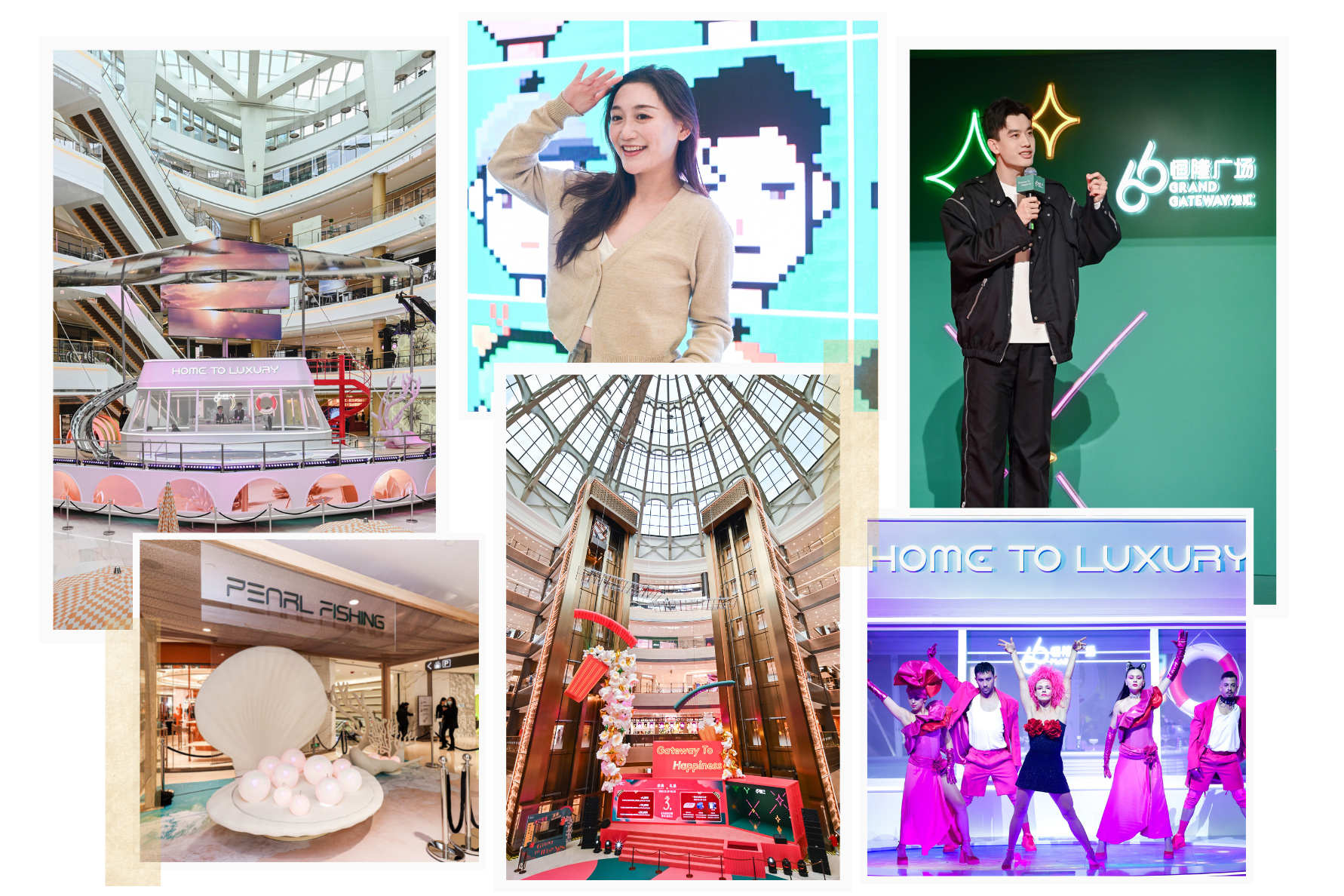

As most of Hang Lung's projects are reaching completion, the Company's strategy has transformed from being one "to acquire and build" and focusing on business-to-business (B2B) into becoming a model that leans more on leasing and management, customer services and business-to-customer (B2C). Hence, the Company's future leaders must have excellent management capabilities. The questions that now come to mind are: how will the new partners of Hang Lung, Weber Lo and Adriel Chan, be able to achieve success and what are Ronnie's expectations of them?

"They (Weber and Adriel) are the fortunate ones while Philip is the most unfortunate. Nelson (Mr. Nelson Yuen) also had a difficult time." Ronnie added, "For Weber and Adriel, what they need to do is to tune up this car (Hang Lung) to a world-class standard and join the Formula 1 (F1) race." Ronnie also referred to Hang Lung as being like a racing car back in an interview he gave Connections in April 2017. He said then that if a car is tuned up properly, it not only saves fuel but, most importantly, wear and tear is reduced and it can travel a greater distance smoothly. In the F1 race, it can be in pole position.

The Effects of Too Much Freedom

"Few have the moral courage to speak up even when something commonly accepted to be true is actually patently false."

In Ronnie's view, there are eight reasons (natural disaster, climate change, pandemics, terrorism, cyber war, hot war, financial collapse and the unintended consequences of technology) that can lead to world disorder. When asked if the "modern slavery of the mind" was the ninth reason, he replied, "No. It is the root cause behind the eight reasons."

Ronnie is also of the opinion that the rise of the "modern slavery of the mind" is the result of people having too much freedom. In this year's Letter, he wrote, "Anyone who ventures to utter the unutterable, i.e. that we already have sufficient or even too much freedom, will be publicly condemned. On this issue, it seems that no one has the freedom to freely think and speak. Social norms dictate what one can think or speak One must be totally politically correct."

"I do not object to having freedom - but just not too much."

Ronnie elaborated, "The ever-increasing demand for freedom in society and the diffused power of a system will give too much freedom of the mind to people, and that causes a loss of control and balance." He pointed out that it is difficult to have checks and balances when there is too much freedom of the mind. This is the force behind the eight reasons that cause world disorder. Ronnie added, "I do not object to having freedom – but just not too much."

About the influence of freedom of the mind on the capital market, Ronnie is of the view that "too much freedom" is one of the two elements that give rise to a potentially dangerous environment for the global economy (the other element is the over-abundance of capital).

He opined that when too much freedom of the mind is applied to the capital market, it takes on the form that bigger is better, faster is better, more efficiency is better, more freedom is better and gain as much of it as possible. Consequently, the market operates in the absence of restraints and becomes a "monster".

Checks and Balances between China and the U.S.

"There are only two economies and countries in the world that have actual power – the U.S. and China."

In last year's Letters, Ronnie described China as being 2.1 meters tall while the U.S. is 2.3 meters tall. A year later, has the height difference changed? He replied, "The difference is getting smaller."

When asked about the prediction that one day China will be "taller" than the U.S., Ronnie said, "I don't think it's easy." He added, "As long as there is no fighting. A strong China is good for the world because they (the U.S. and China) will not fight with each other…This is good for the balance for the world." He pointed out that only the U.S. and China are economies that have actual power while the European Union, comprising over 20 countries, has many cracks and fissures that hamper attempts at joint action.

"We are not afraid of a black swan, we can even say, 'It may not be a bad thing'."

In this year's Letter, Ronnie said the Chinese system is prone to "black swan" events, and Government policy mishaps keep him "awake at night". When asked to elaborate, Ronnie smiled and said, "As the Western saying goes, 'what keeps you up at night?' This does not really wake me up at night."

Although unexpected conditions and developments occur in the Chinese economy, Ronnie is optimistic about Hang Lung's future, and he remains confident that the decision to invest in the Mainland was the right one. He said, "One third of the Taiwanese economy is a grey economy. It is difficult to succeed in its real estate industry. Hong Kong market is good but there are too many investors and too much capital. On the Mainland, not many Mainland companies know how to operate the real estate business but several Hong Kong companies do. Taking into consideration all factors, it is an acceptable risk to run a high-end commercial real estate business on the Mainland."

About "black swans", Ronnie is of view that they pose no problem in principle as long as we manage our financials well. He even said, "It may be good to have a black swan. That may be the time to buy land."

In 2015, Ronnie has devoted more effort to talking about the Company's plans and strategies in the Letters of the Interim Reports. This will enable more timely communication with shareholders and investors so they can understand more about the Company, but will not affect the content of the Letters in the Annual Reports. In the Letter in the 2017 Annual Report, Ronnie analyzes in detail the retail environment plus the Chinese and global economies. In this interview, we focus on only a few areas. If readers are interested in finding out more, please view the full versions of the Letters on Hang Lung's website.

.png)